how to count leverage forex

You have 1000 in your account. Assume a broker offers you 1001 leverage.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_Forex_Risk_Management_Jul_2020-01-44f4b0616f4547ea8cef266cde06cf01.jpg)

Understanding Forex Risk Management

Leverage-adjusted margin Trade volume Contract size Price Margin percentage 100.

. In addition this tool must be used with care. Using a leverage level of 5001 we can dramatically reduce the. This means a trader can enter a.

A leverage ratio calculation is complex however with our forex leverage calculator you just need to input a few values and calculate it easily. Leverage is commonly quoted as a multiple of the capital in your trading account. As we have seen the best leverage ratio on Forex is a relative term.

To measure the leverage for trading - just use the below-mentioned leverage formula. The margin for opening a position is calculated by the formula. 1- How much you are willing to risk.

Also this 20 will already include the spread paid. To measure the leverage for trading - just use the below-mentioned leverage formula. Leverage can greatly amplify your potential profits from even the smallest fluctuations in the currency market.

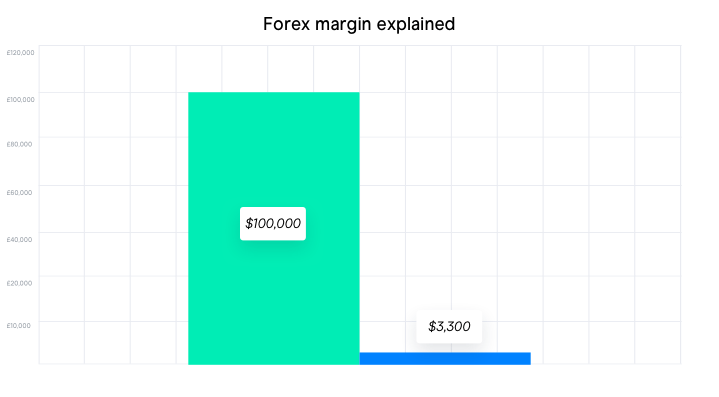

Leverage is essentially using borrowed money to trade. Without leverage in forex trading opening a 1 lot trade 100000 units would require a trader to invest around 127000. Leverage - the ratio of investment to actual value.

Basically all you need to know is two items to come up with the best leverage for your forex strategy. Here are the easiest ones so you can pick a leverage level that benefits your trading style. Based on the margin required by your broker you can calculate the maximum leverage you can wield with.

To calculate the amount of funds required to cover the margin requirement when you open a trade simply multiply the total notional value of your trade quantity x price of instrument by. A leverage of 1100 means a trader can buy a Forex contract of. Leverage removes barriers to entry and.

The margin percentage fixed. Ad Dont miss out on opportunities open an account in 10 minutes. Leverage 1Margin 100Margin Percentage.

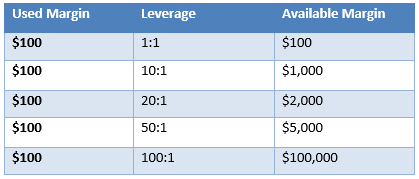

Leverage and Margin Most forex brokers allow a very high leverage ratio or to put it differently have very low pip requirements. It is important to understand the meaning of both terms before trading live. Leverage is inversely proportional to margin.

Leverage 1Margin 100Margin Percentage. So if you have a 3000 account and you trade 30000 worth of. In the case of 501 leverage or 2 margin required for example 1 in a trading.

Ad Dont miss out on opportunities open an account in 10 minutes. Advantages of leverage in forex trading. Using too high a leverage can either bring incredible profits or ruin the trader.

Now if you open 1 mini-lot of 10 000 units then youll be risking 1 for each pip. Leverage in forex is a useful financial tool that allows traders to increase their market exposure beyond the initial investment deposit. Since leverage can amplify both profits as well as losses choosing the right amount is a key risk determination for traders.

Here is the magic leverage formula in simpler words. To open a position traders invest none or a small amount. The answer is 20.

Similarly forex leverage means controlling a large amount of money in currency trading by borrowing from brokers. How to Calculate Leverage in Forex Trading. It offers the potential for.

Leverage in the forex markets can be 501 to. Leverage in forex is a technique that enables traders to borrow capital in order to gain a larger exposure to the forex market with a comparatively small deposit. Currency pair - the currency youre trading.

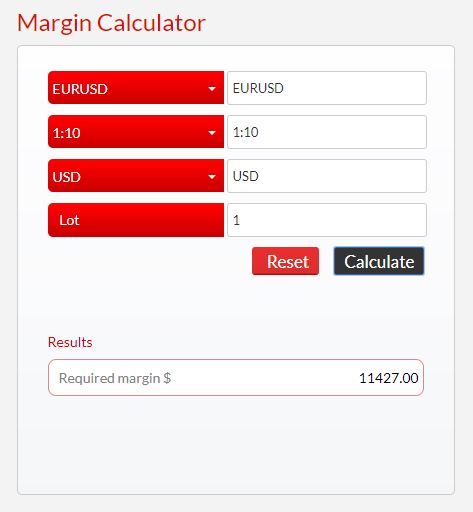

In the forex market most brokers provide leverage with few strings attached but there are a couple things. Using all the formulas illustrated above and the data supplied the Forex Margin Calculator tell us that to open a trade position long or short of a 010 lot EURUSD with a 301. If the margin is 002 then the margin percentage is 2 and leverage 1 002 100 2 50.

Leverage simply allows traders to control larger positions with a smaller amount of actual trading funds. Use training steps to protect your capital and reduce the downside. How to Calculate Leverage in Forex.

To calculate the amount of margin used multiply the size of the trade by the margin. How to Calculate Leverage in Forex. Leverage is how large of a position s you can take in relation to your capital.

For example most forex brokers say they require 2 1 5 or 25 margin.

What Is Margin Level Babypips Com

How To Calculate Leverage Margin And Pip Values In Forex The Smart Investor

Leverage Formula How To Calculate Leverage In Forex Invest Diva

The Relationship Between Margin And Leverage Babypips Com

Forex Calculators Margin Lot Size Pip Value And More Forex Training Group

Best Way To Trade Using A Base Channel Technique In Elliott Wave Theory Aggressivetrading Wave Theory Theories Waves

How Copywriters Can Leverage The Power Of Feelgood Chemicals To Make More Sales Copyblogger Copywriting Copyblogger Digital Marketing

Forex Trading For Beginners Full Course Youtube Forex Trading Forex Mentorship Program

/Courses-Currency-Pairs-Stock-Exchange-Forex-643727-569a829c8446483b945ca8fd1c05e320.jpg)

Forex Leverage A Double Edged Sword

Create And Use A Trading Journal Stock Trading Strategies Trading Forex

How To Calculate Leverage Margin And Pip Values In Forex The Smart Investor

What Are Lots In Forex And How Do You Calculate Lot Sizes Ig Uk Ig En

What Is Margin In Forex Fx Margin Cmc Markets

How To Trade A Leading Diagonal Pattern In Elliott Wave Theory In 2022 Wave Theory Pattern Education

Leverage Formula How To Calculate Leverage In Forex Invest Diva